Lifetime Value Calculator - (LTV)

Use our handy LTV Calculator below to work out the Lifetime Value of your

users. You can also derive the average revenue per user or the average length of your customer

relationships you would need to hit a target LTV. If you want to know how to calculate your Customer

Lifetime Value, feel free to experiment with our LTV calculator.

Why not try out some different scenarios in order to help you understand this pricing model better?

Lifetime Value Calculator (LTV)

What is LTV?

A Lifetime Value (LTV) calculator is a tool that businesses use to predict

the total income that a client will contribute throughout their association with the company. It is

an important measure in marketing and customer relationship management which allows firms to make

more informed decisions about client acquisition expenses, retention methods and overall

profitability.

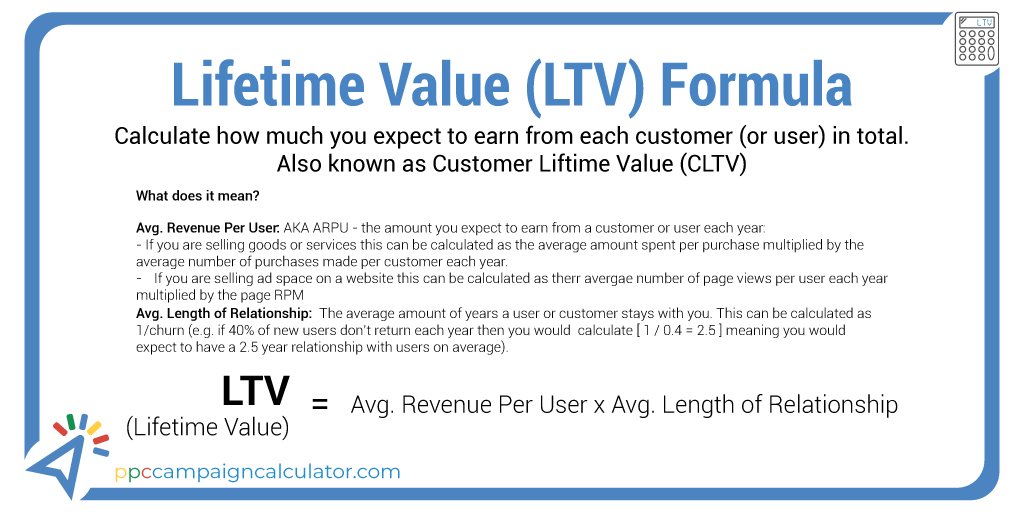

The basic formula for calculating Lifetime Value is:

LTV = (Average Purchase Value × Purchase Frequency × Customer Lifespan)

Here is a breakdown of the components.

- Average Purchase Value:

This is the average amount of money a customer spends on a single transaction. - Purchase Frequency:

This refers to how frequently a customer purchases within a specific time range. - Customer Lifespan:

This refers to the estimated span of the customer's association with the company.

By multiplying these three criteria, organizations may estimate the total value a customer is likely to provide to the company over the course of their involvement. This data is useful for calculating how much a company can afford to spend on obtaining a new client and developing strategies to keep current customers.

Why Lifetime Value Calculator is important?

The Lifetime Value (LTV) calculator is important in business for various

reasons:

- Strategic Decision-Making:

LTV may help companies make strategic decisions by providing useful insights into their customers' long-term value. This information is essential for making strategic decisions regarding client acquisition, retention and marketing expenses. - Marketing Budget Allocation:

Knowing a customer's lifetime worth allows organizations to calculate how much they can spend on gaining new customers. It controls marketing budget allocation and guarantees that the cost of client acquisition is proportional to the potential income a customer is expected to earn over time. - Customer Retention efforts:

Understanding lifetime value enables organizations to assess the performance of their customer retention campaigns. - Product and Service Improvements:

Businesses can utilize LTV data to improve their products or services based on high-value customers' preferences and behaviors. This can lead to enhanced client satisfaction and loyalty. - Financial Planning: :

LTV plays an essential role in financial forecasting. It enables organizations to predict future income and make wise financial decisions based on the estimated value of their customer base. - Resource Allocation:

By identifying client categories with higher lifetime value, companies can use resources more efficiently. This includes customizing marketing campaigns, customer service and other resources to better serve and keep valuable customers. - Customer Relationship Management (CRM):

LTV is an important indicator for CRM initiatives. It helps companies discover and prioritize strong customer connections, allowing them to personalize interactions and provide customized incentives to high-value customers. - Business Valuation:

Understanding a customer's lifetime value is critical for investors and stakeholders when evaluating a company's overall health and value. It can affect investment decisions and help to provide an improved assessment of the company.

How to Calculate LTV

LTV is commonly calculated using three essential components: average purchase value, purchase frequency and customer lifespan. Here is the basic formula:

Let's break down each component:

- Average Purchase Value(APV):

APV is the average amount of money a customer spends on a single transaction. Divide the total revenue by the number of transactions in a given period to get the figure. APV= Number of Transactions / Total Revenue - Purchase Frequency (PF):

It refers to how frequently a customer purchases within a specific time range. This is calculated by dividing the total number of transactions by the number of unique consumers. PF= Number of Unique Customers / Number of Transactions - Customer Lifespan (CL):

CL represents the estimated duration of the customer's association with the company. This could be the average amount of months or years when a customer remains engaged with the company.

LTV = Average Purchase Value × Purchase Frequency × Customer Lifespan

Here's a more detail of the steps:

LTV = (Total Revenue / Number of Transactions) x (Number of Transactions / Number of Unique Customers) × Customer Lifespan

Simplify further:

LTV = (Total Revenue / Number of Unique Customers) × Customer Lifespan

Example:

Let's look at a simple example of calculating the Lifetime Value (LTV) of a hypothetical corporation. Assume we have an e-commerce company called XYZ and wish to compute the LTV for a particular customer segment.

- 1.Average Purchase Value (APV):

Let's imagine a customer spends $50 on average per transaction. - 1.2.Purchasing Frequency (PF):

Assume that clients make an average of four transactions per year. - 3.Customer Lifespan (CL):

Let's say that the average client life cycle is 5 years.

Now, we may use this formula:

LTV = Average Purchase Value x Purchase Frequency x Customer Lifespan.

LTV = $50 x 4 x 5.

LTV = $1,000

In this example, a client in this category has an estimated Lifetime Value of $1,000. This means that, on average, the company expects to earn $1,000 from a customer over the course of their 5-year relationship.

Businesses can use this data to determine how much they are willing to spend on gaining customers in this sector, allocate marketing resources and build strategies to improve client loyalty and retention.