ROI Calculator (Return On Investment)

Find out if your campaigns are actually profitable with this digital marketing

ROI Calculator. [Jump to the calculator]

Proving that a marketing campaign was worthwhile can be difficult for many reasons (see below). Proving

which marketing campaign was the most worthwhile can be even harder.

By measuring Return on Investment you can find out if you are generating a profit from your campaigns in

a quick and simple way. You can also use ROI to understand which of your marketing activities generates

the most profit.

ROI Calculator (Return On Investment)

ROI Definition

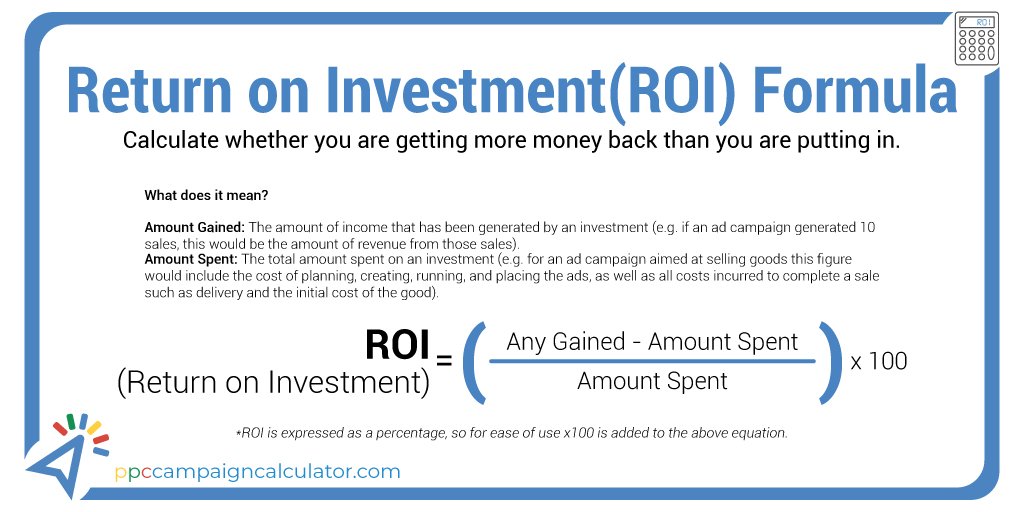

A Return on Investment (ROI) calculator is a tool for determining the

financial performance of an investment. It helps investors and businesses in evaluating the

profitability of an investment by comparing the gain or loss with its initial cost. The ROI formula

is usually expressed as a percentage and can be determined using the following formula:

ROI = {(Current Value of Investment - Cost of Investment) /

Cost of Investment} × 100

Here is a breakdown of the formula.

To calculate the profit or loss, subtract the investment's initial cost from its current value.

Divide the figure by the investment's initial cost to calculate the return on investment.

To express the ROI in percentage terms, multiply the value by 100.

Why Return On Investment Calculator is important?

A Return on Investment (ROI) calculator is useful for a variety of

purposes including finance, business and investment. Here are a few main reasons why a ROI

calculator is important:

- Performance Evaluation:

- Decision-Making:

- Resource Allocation:

- Risk Assessment:

- Performance Monitoring:

- Market Effectiveness:

- Goal Alignment:

- Financial Planning:

- Budgeting:

- Continuous Improvement:

How to Calculate ROI

The equation for change is:

The equation for change is:

Here is a step-by-step explanation of the formula:

- Subtract the investment's cost from its current value:

Gain or Loss = Current Value of Investment − Cost of Investment - Calculate the Return on Investment:

ROI = (Gain or Loss / Cost of Investment ) × 100 - Express the result in Percentage:

To calculate ROI, multiply by 100 and express as a percentage.

In simple terms, you'll take the difference between the current value and the initial cost, divide it by the initial cost and multiply the result by 100 to get the percentage.

Example:

Here is a more practical example.

Assume you bought $5,000 in a stock which is now worth $7,000.

Gain or Loss = $7,000 − $5,000 = $2,000

ROI = ($2,000/ $5,000) × 100 = 40%

Hence, the ROI in this example is 40%, which indicates a 40% return on the initial investment. Positive ROI represents a profit and a negative ROI means a loss.

Conclusion:

In conclusion, the Return on Investment (ROI) is a key metric for evaluating the financial performance of an investment. The ROI formula which compares the gain or loss to the cost of investment, is a simple but effective tool for investors and organizations. The ROI calculator makes it easier to make sensible decisions, allocate resources and develop progressively in a variety of financial situations by expressing the results as percentages.

FAQs:

How does ROI affect everyday decisions?

Answer: ROI guides daily financial decisions by comparing investment returns with

costs which

helps in the strategic allocation of funds for personal finances and budgeting.

Is ROI applicable outside of typical investments?

Answer: Yes, ROI expands its use across many areas including advertising

efficiency, educational

pursuits and time-management decisions by offering ideas for better decisions.